Child Poverty Action Group, December 2021

Debt repayments can leave households with insufficient money, unable to afford basic necessities or deal with unexpected costs that may arise, such as a car breakdown.

The proportion of people receiving a main benefit who are in debt to MSD has been increasing over time. As at June 2008, 50% of people on a main benefit owed a debt to MSD, while in June 2021, this figure was 66%.

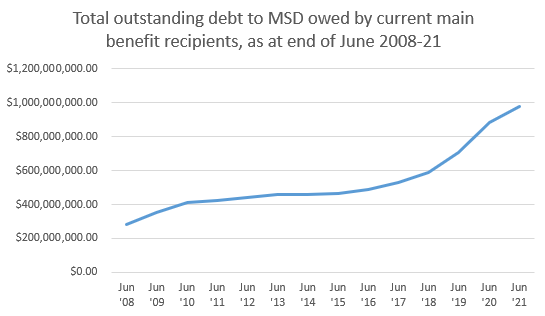

Over this time period, the total outstanding debt among current main benefit clients has increased almost 3.5-fold. Total outstanding debt to MSD was roughly $280 million as at the end of June 2008, yet by June 2021, this figure was $980 million.

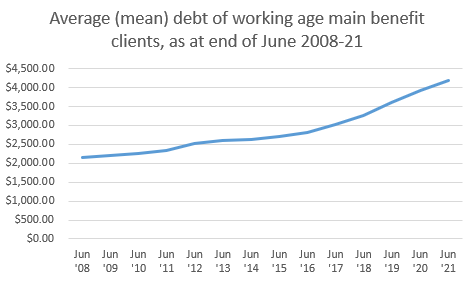

Similarly, the average (mean) debt to MSD has been increasing, doubling from roughly $2,000 in 2008 to over $4,000 in 2021.

Beneficiaries may owe MSD debt due to overpayments, repayable hardship assistance, or in some cases, fraud.

Overpayments occur where households are paid more than they are entitled to, an issue that is exacerbated by the complexity of the welfare system. The Welfare Expert Advisory Group described the benefit and tax credit systems as “unmanageably complex”. At present, the layers of bureaucracy that users must navigate can make it difficult for people to ensure they are meeting requirements, resulting in overpayment due to, for instance, a change in someone’s work circumstances or transferring to another benefit. In order to minimize overpayments and reduce the negative impacts of debt repayments, the welfare system needs to be redesigned to be more accessible and user-friendly as per WEAG’s recommendations.

People also accumulate debt to MSD by taking out loans – known as receiving ‘hardship assistance’ payments – to meet their basic needs. Hardship assistance payments include Benefit Advances, Recoverable Assistance Payments, or Special Needs Grants. While Special Needs Grants generally don’t have to be paid back, and Recoverable Assistance Payments are only for those who aren’t on a main benefit, Benefit Advances are interest-free loans taken out by beneficiaries to pay for essential or emergency costs such as bonds/rent, car repairs, or school costs.

MSD data does not break down debt by reason; however, the number of people receiving Benefit Advances has increased over the last decade. The fact that beneficiaries are having to access these payments for basic needs speaks to the inadequacies of benefit levels in the first instance. Benefit levels must be raised in order to enable households to meet their basic needs without taking out loans from MSD, thus trapping them into cycles of debt.

CPAG has previously called for an independent review of the legitimacy of beneficiary debt and the operation of the investigation and prosecution unit of MSD. With evidence of significant write-offs of superannuitants’ overpayments, it is clear that beneficiaries are unduly punished in ways that pensioners are not. CPAG is therefore calling for MSD to cease collecting debts from beneficiaries in order to prevent exacerbating child poverty among the lowest-income households. As families face the devastating economic impacts of COVID-19, this call is now more urgent than ever.

Debt data sourced by response to an Official Information Act request to the Ministry of Social Development received on 22/09/21.

All benefit data sourced from Benefit Fact Sheets.